We hear from clients all the time with questions about how to acknowledge gifts from Donor Advised Funds (DAFs).

Free DAF Acknowledgement Template included below!

Whether this is your first gift from a DAF, or you’re sending tax receipts for such gifts left and right with a sneaking suspicion your T’s may not be crossed properly, we’ve got you covered. Below are the 5 steps to properly acknowledge a gift from a DAF:

5 Steps to Acknowledging a Gift From a Donor Advised Fund

Inspect

In addition to the size of the gift, the check or corresponding paperwork will likely provide two critical pieces of information: the name of the donor or donor family advising the fund from which the gift came, and the name of the fund itself (i.e. Fidelity Charitable, National Philanthropic Trust, etc.)

Log

Immediately attribute the gift in your donor base or tracking system to the DAF itself. Legally, your gift is from the fund - not the donor advising it or their “donor account”. This is an important, often misunderstood distinction.

Indicate a Soft Credit

Indicate in your records the name of the donor advising the fund, if provided. We advise that your system link the donor advisor with the fund through which they sent their gift for good practice.

Send a Thank You Letter

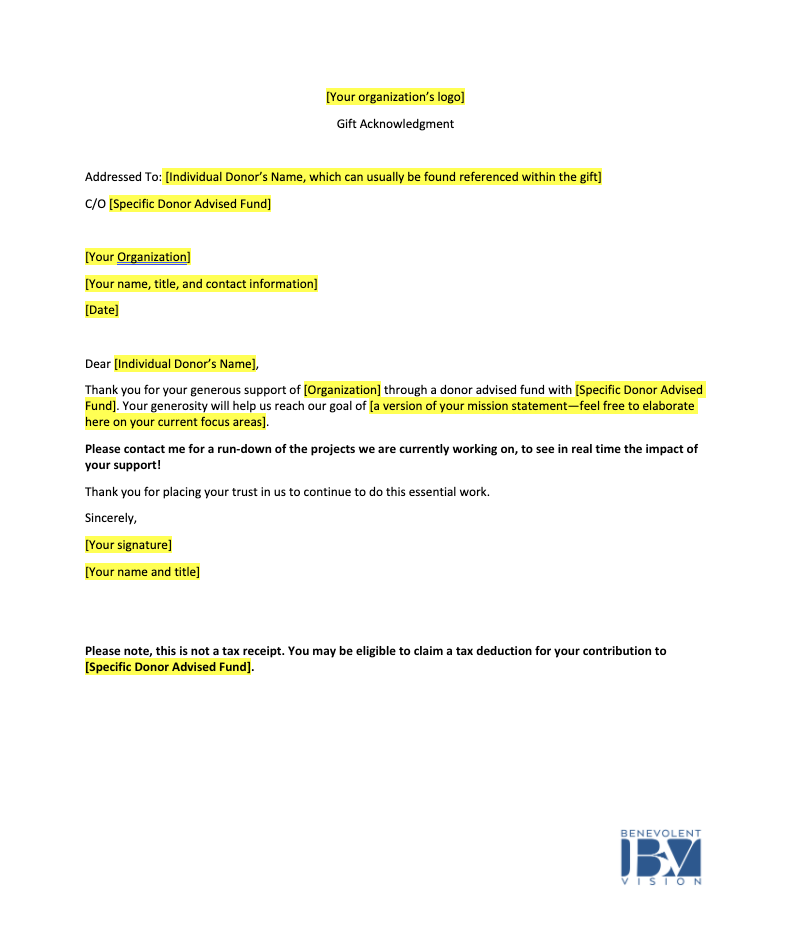

Send a standard thank you letter to the donor advising the DAF, C/O the DAF. This letter is not a tax receipt, but serves as an important element of donor engagement. Short on time? Download Benevolent Vision’s “DAF Acknowledgement Template” below.

Send a Tax Receipt

For purposes of compliance you are not obligated to send a tax receipt to the DAF itself. However, Benevolent Vision recommends that you stick to standard procedures for every gift you receive. Send the DAF whichever formal tax receipt letter you would normally send a donor.

That’s all there is to it! We hope we’ve provided clarity on how to acknowledge gifts from donor advised funds.

Reach out to clientsupport@benevolentvision.com with any questions - we love to hear from you!