The world was taken by surprise when the owner of Patagonia, Yvon Chouinard decided to give his company away to fight the ongoing climate crisis. Chouinard birthed Patagonia in 1973 from his own deep interest in rock climbing. His decision to have all the profits from the business funneled to trusts and nonprofits dedicated to climate change was not only remarkable but was a decision we as advisors and consultants can all learn from.

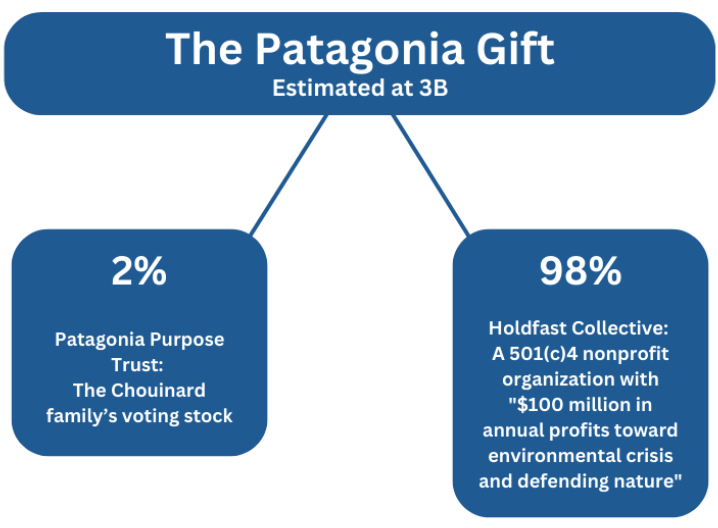

To understand the weight of these actions, let’s examine what the gift looks like. According to Bloomberg, all shares of Patagonia were worth an estimated 3 billion dollars. Two percent of the company (voting shares held by the family) was donated to the Patagonia Purpose Trust which will maintain control of the corporation. The remaining 98% of the gift are common shares donated to the Holdfast Collective a 501(c)4 nonprofit which due to its status can make both charitable and political contributions. The ability to make these political contributions was clearly a top priority in Chouinard's strategy to fight climate change. However, the donation to Holdfast itself is not eligible for a charitable tax-deductible as it is a 501(c) 4 rather than a 501(c)3.

The Chouinard family paid an estimated $17.5 million in taxes on this contribution. This is definitely a large sum, but minimal in comparison with the estimated $700 million which would have been due for capital gains taxes had the company been sold.

As a community of advisors who facilitate gift design, grants and philanthropic efforts, there is frequently a tendency to focus on the creation of a public 501(c)3 or private family foundation. But these vehicles are not always the best solution. In the case of Patagonia, prioritizing the donor’s intention, examining all possibilities and leveraging the power of the 501(c)4’s ability to influence issues via political contributions created an elegant solution when combined with the use of a trust to hold the voting shares (control).

Dedicating the company to fighting climate change required an intense thought process by experts from various disciplines ranging anywhere from corporate executives to tax exempt organization attorneys. Experts from all fields had to come together to strategically solve Chouinard’s simple directive - to ensure that Patagonia would forever live on to support saving the planet.

This gift was monumental because of its potential impact current and long- range impact. It powerfully illustrates ways we can disrupt and challenge existing infrastructure and systems through philanthropy.